Top Features of AssetPlus That Simplify Mutual Fund Distribution

- AssetPlus

- Mar 4

- 7 min read

Simplify SIP Tracking Automation with Top Mutual Fund Distributor Tools

The world of finance is constantly and rapidly evolving! When we talk of the mutual fund distribution business, digital transformation has become a necessity that helps distributors reduce operational complexity and increase client engagement.

Top trends include:

AI, Data Analytics, and Blockchain Technology Integration.

Increased attention to investor education, client engagement, and experience.

Shifts in regulation and emphasis on compliance.

Growing use of digital media.

Considering this need, it is paramount for distributors to use the most effective mutual fund distributor tools, which help them maintain efficiency and include functionalities like SIP tracking automation.

AssetPlus is one of the best solutions for both new and seasoned MFDs. This guide covers key AssetPlus features, where unique and extensive mutual fund distributor tools have been carefully designed to simplify the process.

About AssetPlus

AssetPlus is a unified app that offers an array of services that include mutual fund distribution, corporate fixed deposits, term and health insurance products, and retirement planning through the National Pension Scheme.

AssetPlus has onboarded more than 13K MFDs, which, in the aggregate, manage the financial needs of over 1 Lakh investors, mutual fund assets worth more than 4500 Cr, and a SIP book of 80 Cr.

The platform offers everything in the wealth tech category, from a KYC tool that verifies customers' identities to transaction management, advanced PMS, and much more, all from one dashboard. Here are some powerful facts about AssetPlus:

Founded by IIT graduates and backed by top entrepreneurs, today it boasts 14000 plus partners.

It is a top-rated distributor platform with more than 3 lakh monthly transactions.

It has a strong team of 170 plus employees who help you collaborate, grow, and succeed and offer 7 days of client services support.

AssetPlus Features Including Top Mutual Fund Distributor Tools

Today, AI can empower MFDs to provide better and more result-oriented solutions for investors.

According to Shalab Gupta Bibhab of Bibhab Capital Agra MFD, "For MFDs, AI has the potential to revolutionize both client servicing and investment process and enable MFDs to provide more personalized and effective solutions to investors."

AssetPlus is a best-in-class electronic platform developed for mutual fund distributors. Below are some of the core AssetPlus features and how they can benefit MFDs:

1. Fund Finder: Easy Investment in Under One Minute

Fund Finder is one of AssetPlus's star features. It is engineered to empower MFDs to quickly access the right mutual fund choice. Its intuitive filters and smart recommendation algorithms sift through the vast database of funds and allow you to select the right investment options based on specific client criteria within less than a minute.

Fund Finder bases its fund recommendations on:

Long-term goals vs. short-term trends

Market diversification coverage

Volatility of equity investing and potential returns

Risk tolerance

Investment portfolio control

MFDS needs to assess the funds that are appropriate for investors.

According to Rajesh Minocha, CFP and founder of Financial Radiance, "The conservative investor seeks capital preservation and steady growth without investing in any sectoral, thematic, or small-cap funds. Treat with caution any investment that promises high returns with little or no risk."

Core Capabilities of Fund Finder

Intelligent Filtering: Narrow down fast by risk profile, performance metrics, fund category, etc.

Real-Time Data Integration: Utilizes current market data to ensure that the recommendations match the prevailing trends.

User-Friendly Interface: Designed to be intuitive and efficient, saving you time on research.

Other Services: This tool also helps delete and add funds, adjust the investment amount, personalize messages, and notify the client of the chosen options.

How to Use Fund Finder

Follow these 3 simple steps to access the tool:

Step 1: Provide Investment Type, Investment Amount, and Investment Tenure

Step 2: Select Risk Appetite

Step 3: Customize and Share the Proposal with the Client or Add it to the Cart

2. CAS Upload: Seamless Management of Client AUM

It is cumbersome and time-consuming to manage the AUM of a client in a manual process. The CAS Upload feature enables the automated process of data entry, thus enabling the error-free updating of the portfolios of the clients.

Key Capabilities of CAS Upload

Single Dashboard: The CAS Upload feature allows distributors to view every client's portfolio and mutual fund holdings in one window.

Automation of Data Input: The work involves fewer mistakes when it updates information for a client.

Integration with SIP Tracking Automation: It instantly captures SIP tracking integration, the repetition of investment, and portfolio changes.

MFDs benefit by automating cumbersome administration work and strategizing client interactions. They also ensure that the client's information is always current and correct.

3. Events Page: Prepare for Online/Offline Interactions

In the dynamic world of mutual funds, continuous learning and networking are must-haves. The Events Page offers a rich calendar of events in the mutual fund industry, webinars, seminars, and even in-person events, so you don't miss out on any opportunities to upgrade your knowledge or increase your professional circle.

Key Capabilities of Events Page

Centralized Event Listings: You can browse and register for upcoming events using an easy-to-navigate interface.

Notifications Alert: Get reminders and alerts about events that match the user's interest and professional development needs.

Events Description and Schedule: This section will help users access information about event descriptions, schedules, and registration links.

Using this section, MFDs get valuable information related to seminars and even in-person events. Partners can access online courses for training purposes, refer to webinars, and make the most of upcoming and outreach events.

4. ChannelPlus: Learn and Apply with Past Webinar Recordings

ChannelPlus is a great learning hub that contains many past webinar recordings. This source of knowledge has been built for continuous professional development, and users can return to sessions with expert leaders at their own pace.

ChannelPlus is exclusively for empanelled partners. Its best feature is that even if MFDs miss a webinar, they can view recordings and get the needed information.

Key Capabilities of ChannelPlus

Tremendous Webinar Library: All sessions recorded on virtually all topics—market analysis up to advanced investment strategies.

Search and Filter Options: You can locate webinars either by topic, date, or speaker.

On-Demand Learning: The convenience of flexible scheduling allows you to watch sessions as convenient for you.

MFDs can continuously learn and upgrade to maintain a competitive position in a changing market. They can learn practical strategies and new insights from high-caliber industry professionals and apply them directly to your business.

5. Co-Branded Marketing Material: 700+ Ready-to-Use Posters

Marketing stimulates mutual fund distribution growth. AssetPlus features a library of more than 700 co-branded marketing posters that can help you create a professionally appealing image for your services.

Partners can build their brand, and that too, free of cost, with personalized posters, videos, and web stories. They simply need to download it and use their name and contact details to customize it.

Key Capabilities:

Diverse Templates: Access professionally designed marketing materials that fit with your branding.

Instant Deployment: Distribute these posters across current or potential clients using digital distribution channels.

Consistent Messaging: Ensure that your marketing communications are consistent, on-brand, and professionally appealing.

Marketing Materials: This section offers 900 plus marketing materials that are available in multiple languages.

MFDs can enhance their professional image and gain clients' trust with high-quality, co-branded materials.

6. BizGuru: Your Go-To Knowledge Hub

BizGuru is an interactive Q&A system developed exclusively for mutual fund distributors. It covers usual objections, situational queries, and conceptual problems. It acts as the centralized depository of expert opinion and best practice.

Key Capabilities:

Comprehensive Q&A Library: Get the answers to questions and industry-related issues.

Expert Insights: Get insight from experts as well as from industry experts.

All Queries Answered: MFDs deal with objections, situational queries, and conceptual problems.

Crisp Solutions: It is a one-of-a-kind list in English and Hindi that can help you with ready-made solutions to resolve business challenges.

Massive Library of Answered Queries: Partners can refer to questions that experts have elaborately answered.

BizGuru serves as a dependable resource for on-demand assistance, ensuring you’re never left without guidance.

7. Resources: Boost Your Knowledge with 100 + Presentations

The resources section is a treasure trove of knowledge. It provides over 100 presentations covering a wide range of topics relevant to the mutual fund industry.

The presentations are designed to help you stay updated about market trends, investment strategies, and regulatory updates.

Its best feature is that MFDs save time as they have ready-made presentations and other resources, which can help them build conversation and business with prospective clients. Key Capabilities:

Presentations: It consists of 100-plus presentations on insurance, investment, and business development.

Range of Topics: Access presentations on everything from market trends and economic forecasts to detailed investment strategies.

Best Quality Content: The content is always prepared by industry experts; thus, it is accurate and applicable.

Easy Accessibility: The page's friendly design allows you to access and directly download the presentations on any topic that you need immediately.

MFDs can always refresh their knowledge and have detailed presentations at hand, which can help them predict and depict market and investment trends.

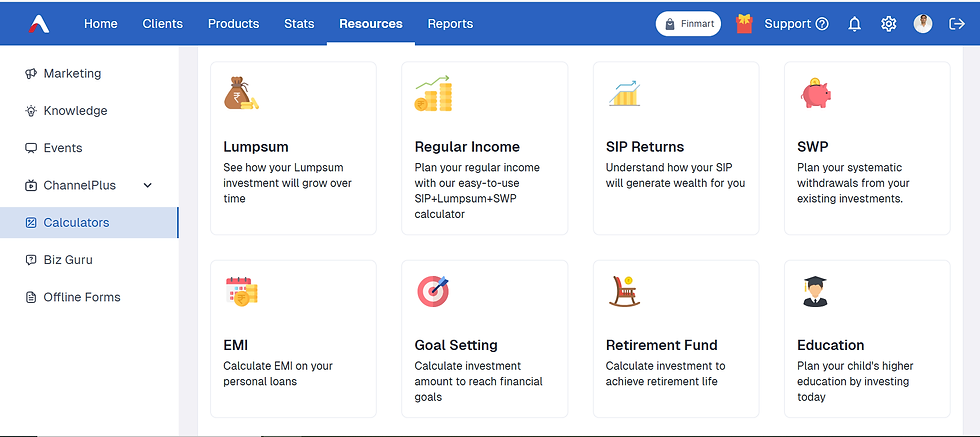

8. Calculators: 12 Tools for Goal-Based Investing and Future Planning

Accurate financial planning is an important component of mutual fund distribution success. AssetPlus features 12 specialized calculators to help you model various investment scenarios and craft customized financial strategies for your clients. These calculators are:

Regular Income Calculator

Revenue Calculator

Compound Interest Calculator

NPS Calculator

Primary Capabilities:

Goal-Based Analysis: These calculators enable you to calculate how different investment choices can help clients meet their long-term financial goals.

Scenario Simulation: Simulate scenarios to predict the portfolio's future performance based on variables such as the amount invested, risk appetite, and market conditions.

MFDs can help investors with data-driven insights, resulting in increased client retention. Some of the calculators are SIP Calculator, Lumpsum Calculator, Retirement Calculator, and Mutual Fund Returns Calculator.

Conclusion

AssetPlus is a holistic platform that redefines mutual fund distributor tools and operations management. Assetplus features empower MFDs with powerful tools to simplify everyday work and facilitate better strategic decisions. SIP tracking automation also enables the distributors to offer prompt and efficient client service.

Since digital transformation continues to dominate the financial services sector, incorporating robust platforms such as AssetPlus is no longer a choice but a necessity.

Sign up today and explore AssetPlus features today and empower your business with technology that works as hard as you do.